Income Tax Reliefs for Tax Residents in Singapore either local or foreign tax-resident. E e-E March 31 2022.

Income Tax Deadline Extended Until 30 June 2020

20th day of last month of each quarter.

. The FPX Financial Process Exchange gateway allows you to pay your income tax online in Malaysia. 31 July of the year following the tax year if the taxpayer instructs a professional tax adviser the deadline is extended to the end of February of the following year. Additionally consider filing a tax extension and e-file your return by the October deadlineCheck the PENALTYucator for detailed tax penalty fees.

All international students inside the. Australia Last reviewed 27 June 2022 Generally 15th day of the seventh month following the end of the income year. The filing deadline for tax returns has been extended from April 15 to July 15 2020.

This filing and payment relief includes. Under Decree 125 penalties for non-compliance. Any payable balance resulting from the annual income tax return must be paid not later than the due date established for filing the return.

Not all US states require that you file a tax return on the state level however many do. GOVERNACE ADVISORY. Sales tax exemption for the importation of multimedia equipment Learn More.

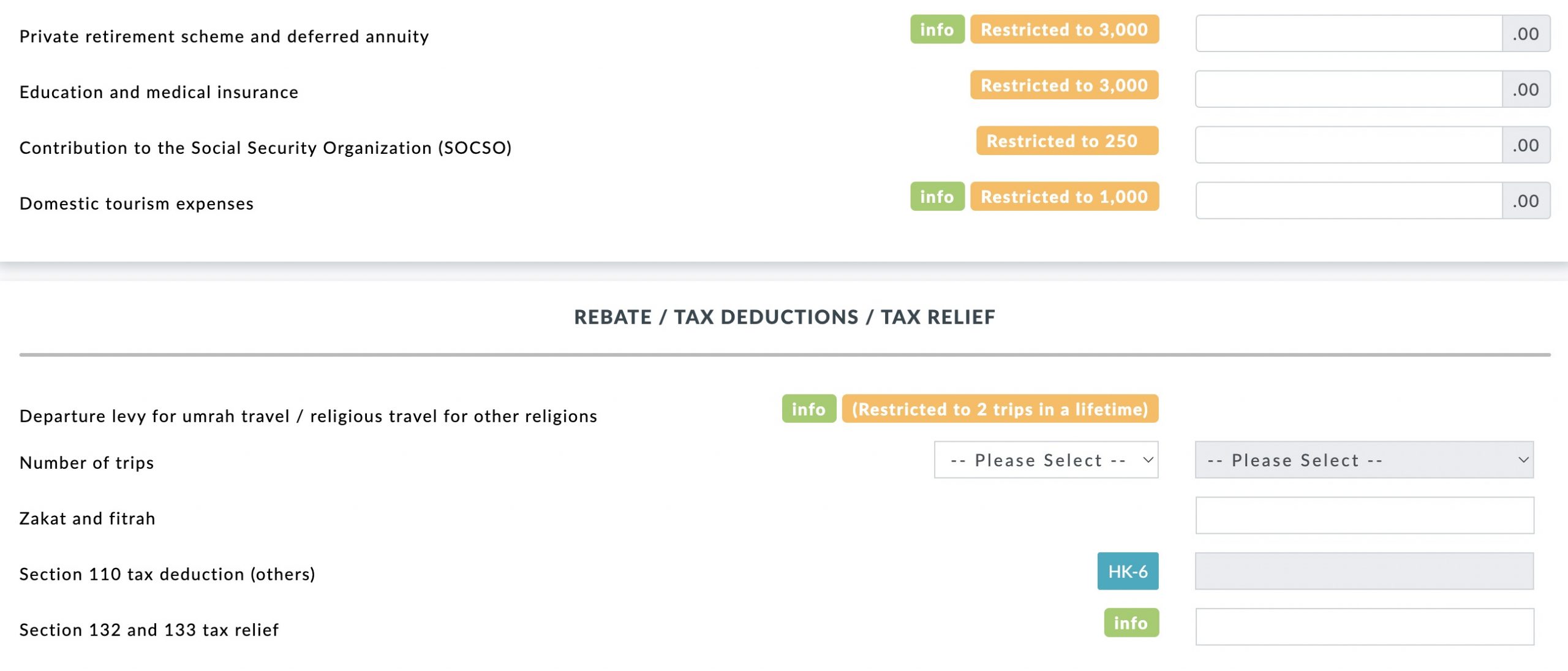

Save Income Tax Accountant Oil Gas You need to sign in or create an account to save. MSC malaysia BOG 5 revised tax regime comes into force on 1 july 2021 Learn More. Even though the progressive rates for personal income tax rates range from zero to 22 percent in Singapore the effective payable tax may come out to be much lower if one takes advantage of the various schemes the Singapore Government has initiated.

For the 2021 tax year deadlines have been extended to 31 October 2022 31 August 2023 if tax adviser is instructed. A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia. Resident who carries on business.

For those who cant file by the July 15 2020 deadline the IRS reminds individual taxpayers that everyone is eligible to request an extension to file their return. Form C Deadline. President Joe Biden signed into law Aug.

The deadline for tax payment is the same as tax finalization meaning no later than 90 days from the end of the calendar year. If you have never filed your taxes before on e-Filing income tax Malaysia 2022 go to https. Malaysia follows a progressive tax rate from 0 to 28.

The participating banks are as follows. The IRS deadline to file tax returns on the federal level is April 18 2022. Senior Internal Auditor.

16 a sweeping tax reconciliation bill with more than 450 billion in tax increases and 260 billion in energy tax incentives. Maximum Refund Guarantee Maximum Tax Savings Guarantee - or Your Money Back. B e-B June 30 2022.

P e-P June 30 2022. View details Senior Internal Auditor. 5376 passed the House on Aug.

Beginning year of assessment 2020 a company has to self assess income tax payable and submit the declaration to LHDN using Form CAccording to PWC Malaysia taxpayer has to indicate if the Company is involved in any controlled transaction. Personal income tax PIT due dates PIT return due date. BE e-BE April 30 2022.

In 2019 Infosys was awarded a contract to develop the next generation income tax filing system to reduce processing time for returns from 63 days to one day and expedite refunds. 12 by a vote of 220-207 after passing the evenly divided Senate on Aug. Form C refers to income tax return for companies.

1 Pay income tax via FPX Services. PAYE became a Final Withholding Tax on 1st January 2013. Resident who does not carry on business.

If you get a larger refund or smaller tax due from another tax preparation method well refund the applicable TurboTax federal andor state purchase price paid. Why its important to start early. Temporary waiver of the location condition.

This is because the correct amount. TurboTax Online Free Edition customers are entitled to payment of 30 Limitations apply. Resident Individual Knowledge Worker Expert Worker BT e-BT April 30.

Able to lead and undertake internal audit engagement responsible and committed to meet tight deadline detailed in work and a team player. First of all you need an Internet banking account with the FPX participating bank. Final in the sense that once an employer deducts PAYE from the gross salarywage of a particular employee it represents the final tax liability on that income.

The legislation known as the Inflation Reduction Act HR. Check your states website to find out if you have state tax filing obligations and to see what the deadline to file is on the state level. Here are the many ways you can pay for your personal income tax in Malaysia.

An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality. Armenia Last reviewed 07 June 2022 20 April. Keep in mind that state deadlines will differ.

The Income Tax Act 1961 states under sections 237 to 245 that tax refunds can be granted in cases where the amount of tax paid by a person or someone on hisher behalf is more than the amount. Submission deadline for the application for transition under services incentive is extended to 31 december 2021 Learn More. Tax authorities are strictly enforcing tax deadlines and require that PIT declarations are filed for each month in the previous year.

As a result most employees will not be required to lodge Form S returns. The IRS urges taxpayers who are owed a refund to file as quickly as possible.

Guide To Using Lhdn E Filing To File Your Income Tax

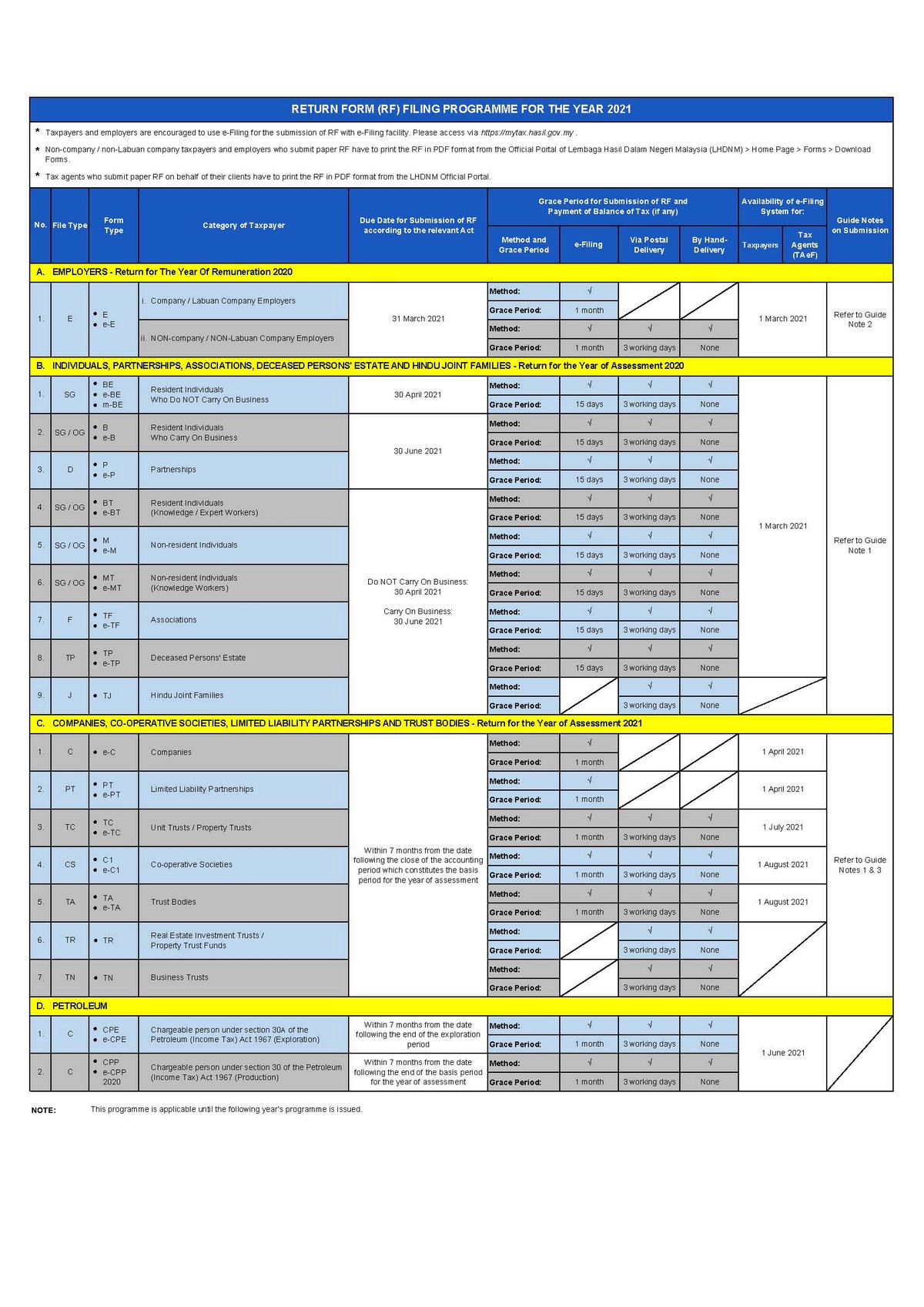

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Malaysia Personal Income Tax Guide 2022 Ya 2021

Malaysia Personal Income Tax Guide 2021 Ya 2020

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Malaysia Personal Income Tax Guide 2022 Ya 2021

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Personal Income Tax Guide 2022 Ya 2021

Income Tax Refund Check Eligibility Process To Claim Tax Refund

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates Facebook

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Income Tax Number Registration Steps L Co

Extend Due Date Immediately Trends As Income Tax Return Itr Last Date For Ay 2022 23 Nears The Financial Express

Ebi Software Kindly Take Note On The Income Tax Submission Deadline In 2022 For 2021 Calendar Year To Avoid Penalty Ebi Ebipos Ebisoftware Possystems Taxsubmission Incometax Lhdn Taxseason2022

No Extension For Income Tax Filing The Star