To satisfy the consistent basis reporting requirements the estate. MissouriBUYS is a secure user-friendly web-based statewide eProcurement system implemented by the State of Missouri with its partner Perfect Commerce a PROACTIS Company using their WebProcure applicationMissouriBUYS is a one-stop shop for procurements by state government agencies and includes vendor self-service registration and profile updates solicitations both.

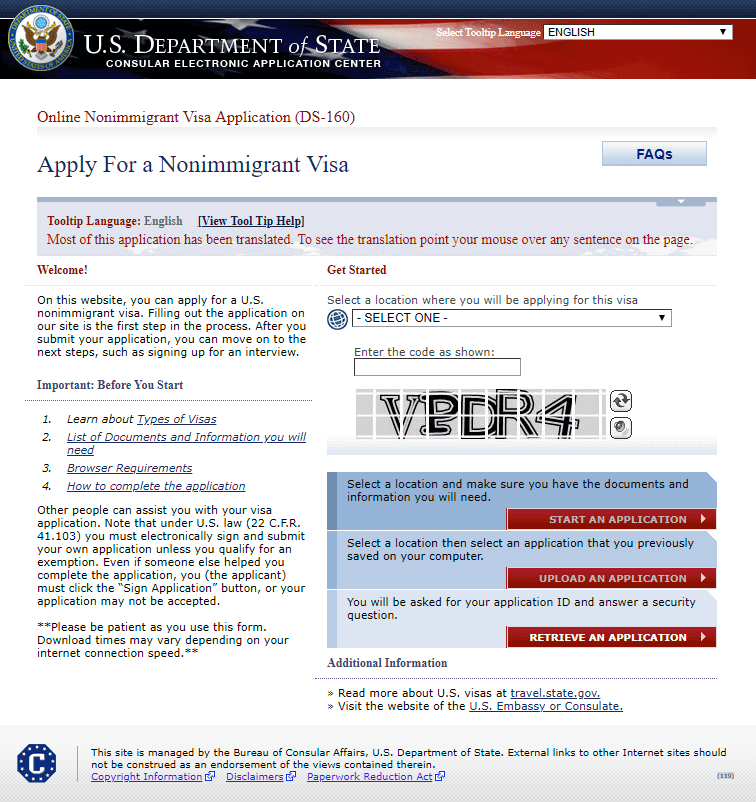

Ds 160 Form Comprehensive Guide To Filing The Online Us Visa Form

Send general questions about USPTO programs to the USPTO Contact Center UCC.

. Know GSTR 3B due date Format Filing and late filing penalty for each tax period. Of Form 706 or the date of filing Form 706 if the return is filed late. 1 Reports as soon as possible and no later than Tuesday June 21 2022 in order to comply with the EEOCs mandatory filing requirements.

Avinash Indoria January 6 2020. 10222019 90246 AM. 2019 2020 and 2021 using ReFILE.

The EFILE and ReFILE services are open for transmission from February 21 2022 at 830 am. 2019 Form 5500 Schedule A - Insurance Information Author. Late-filing penalty relief for tax years 2019 and 2020 will only be applicable to tax returns filed no later than September 30 2022.

Using their existing Georgia efiling credentials attorneys and filers can now view cases and documents filed across the. To ask questions about Patent e-Filing or to suggest improvements to the online system or report technical problems please call the Patent Electronic Business Center at 866 217-9197 toll free or send email to EBCusptogov. The Chartered Accountant must be registered with e.

Enter the Membership Number of the CA Form Name and Assessment Year. Employee Benefit Security Administration Created Date. The basis of certain assets when sold or otherwise disposed of must be consistent with the basis estate tax value of the asset when it was received by the beneficiary.

The Annual 2019 tax return is due April 15 2020 If the due date falls on a weekend or legal holiday the due date is extended to the next business day. And you dont receive a final decree of divorce by the due date for filing the gift tax. Quarterly returns are due the end of the month following the tax quarter.

Late fee for delayed filing of FORM GSTR-1 to be auto-populated and collected in next open return in FORM GSTR-3B. The 400200 non-electronic filing fee fee codes 109020903090 or 169026903690 must be paid in addition to the filing search and examination fees in each original nonprovisional utility application filed in paper with the USPTO. 2019-CV-012345 reSearch GA is now available.

The 2022 EEO-1 Component 1 data collection is tentatively scheduled to open in April 2023. Taxpayers who have filed their tax. T3 Trust Internet Filing vs T3 EFILE.

This Form is Open to Public Inspection. Taxpayers who have yet to file their 2019 andor 2020 federal income tax returns should do so soon and we highly recommend they make every effort to file electronically. The Quarter 1 Jan Feb Mar tax return is due April 30 Annual returns are due April 15.

Updates regarding the 2022 EEO-1 Component 1 data collection including the opening date will be posted to. No information by CBIC extended GDTR 3B return filing due date for December 2019. Click on My Chartered Accountant button and Add.

Please use four-digit year the dash CV or CR and a 0 in front of your case number. For a list of T3 Trust returns that can use internet filing. The same is true of alimony paid under a divorce or separation instrument executed before 2019 and modified after 2018 if the modification expressly states that the alimony isnt deductible to the payer or includible in the income of the recipient.

LOGIN to e-Filing application and Go to My Account My CAERI.

How To E Verify An Itr Using Hdfc Netbanking In 2021 Tax2win

Raise Service Request User Manual Income Tax Department

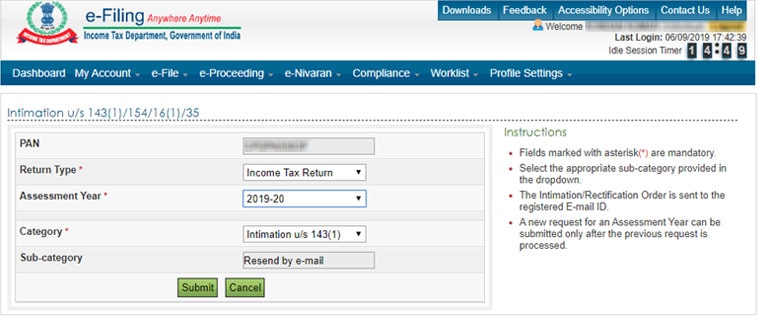

Notice U S 143 1 Income Tax Intimation U S 143 1 Tax2win

Ds 160 Form Comprehensive Guide To Filing The Online Us Visa Form

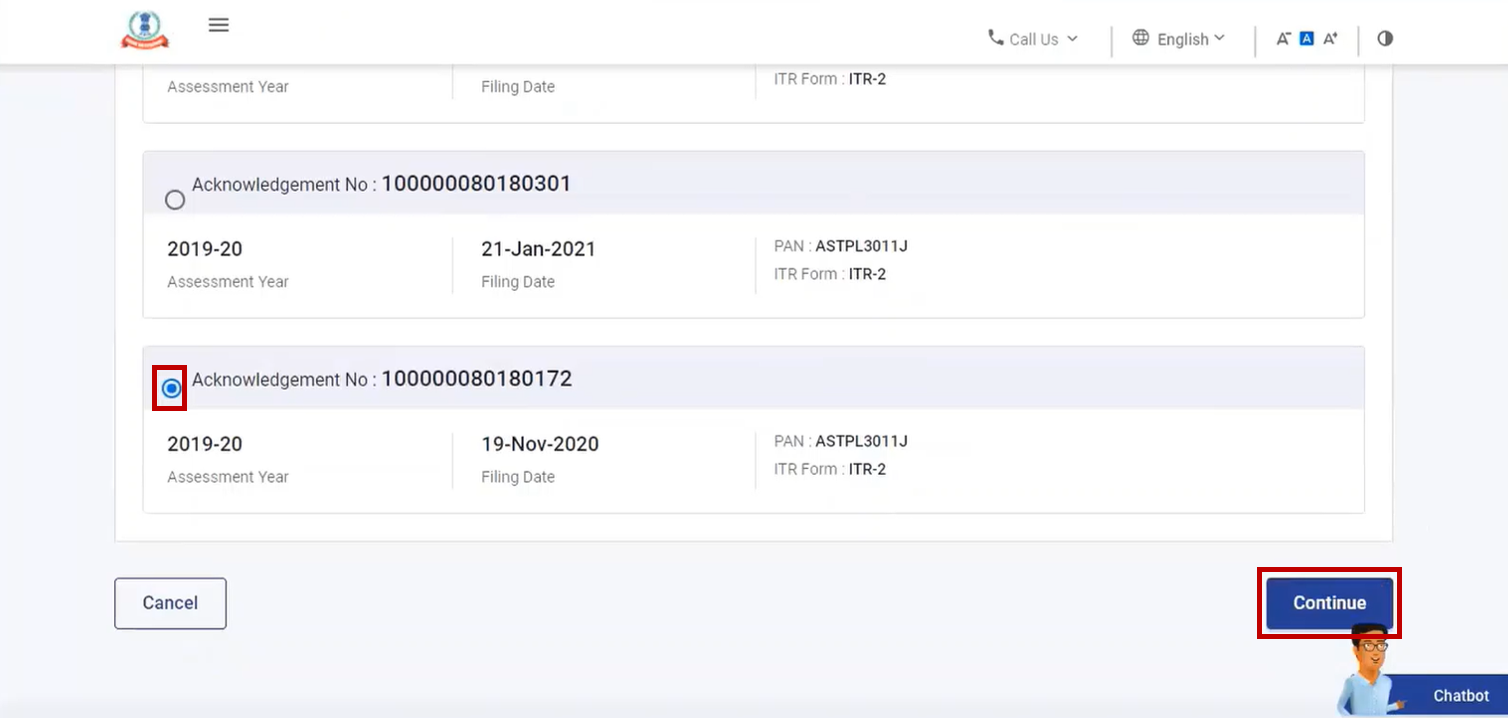

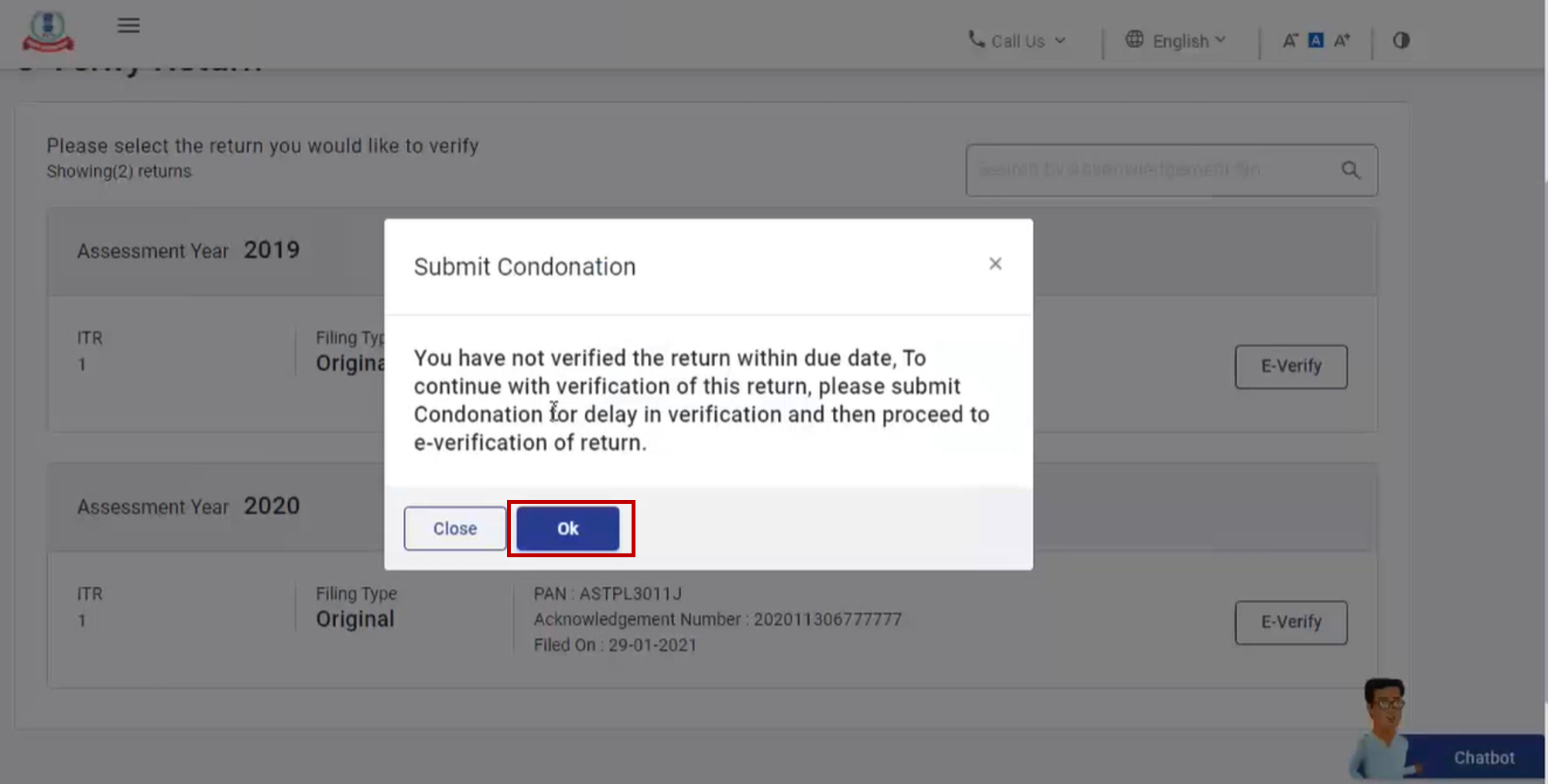

How To E Verify User Manual Income Tax Department

Raise Service Request User Manual Income Tax Department

7 Ways To Open Event Viewer Windows 10 How To Use Event Viewer Windows 10 Data Recovery Tools Viewers

Itr Filing Late Fee To Jail Term If You Miss Due Date Mint

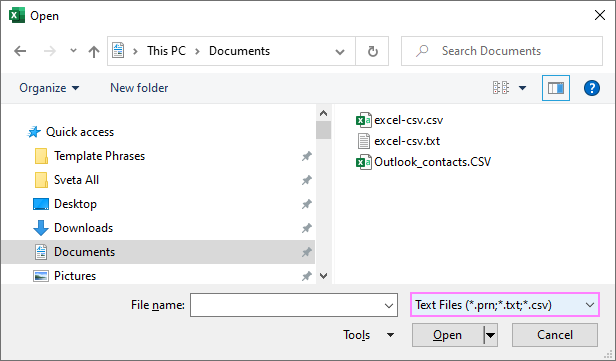

How To Convert Csv To Excel By Opening Or Importing

S Corp Federal Tax Filing Dates Turbotax Tax Tips Videos

Introduction To Wudfhost Exe And The Way To Stop It Windows System Stop It Windows Defender

2022 Irs Tax Refund Schedule Direct Deposit Dates 2021 Tax Year

How To Access Online Statements On Easyweb

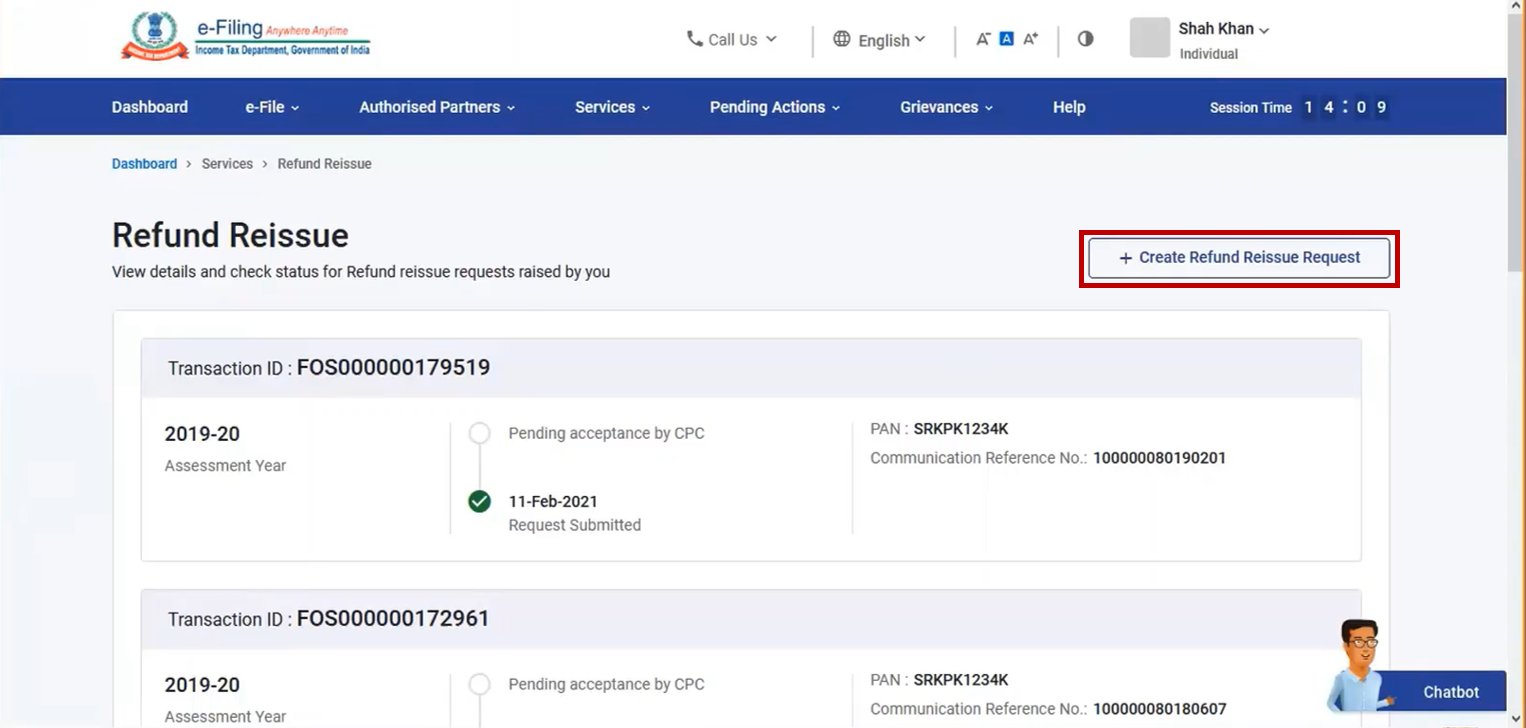

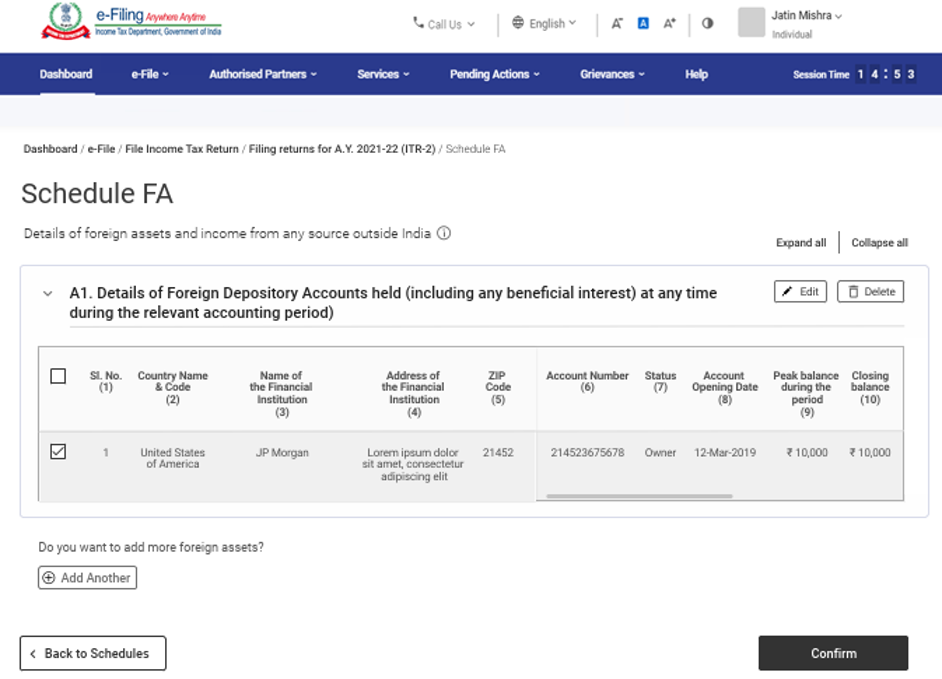

File Itr 2 Online User Manual Income Tax Department

How To Date A Letter Indeed Com

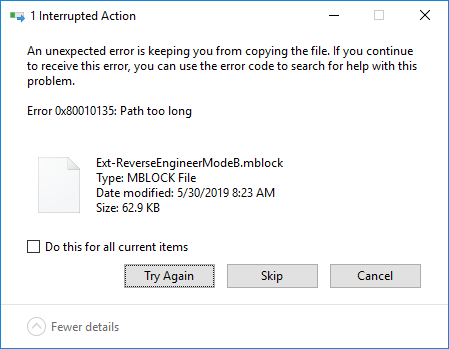

I Get A Path Too Long Error When Trying To Open An Electronic Copy Of A Book On Windows Technical Information Library

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Top 7 Fixes To Dpc Watchdog Violation Windows 10 For 2022 Windows Programs System Windows System

As Per The Changed Rules Notified Under Section 234f Of The Income Tax Act Which Came Into Effect From April 1 2017 Income Tax Filing Taxes Income Tax Return